Absolute’s operating revenue jumped 12.7X to INR 360.9 Cr in FY22 from INR 28.4 Cr in FY21

In line with the rise in revenue, Absolute’s expenses shot up to INR 397.9 Cr from INR 32.5 Cr in FY21

The startup, backed by the likes of Sequoia and Tiger Global, helps farmers grow crops without using synthetic enzymes

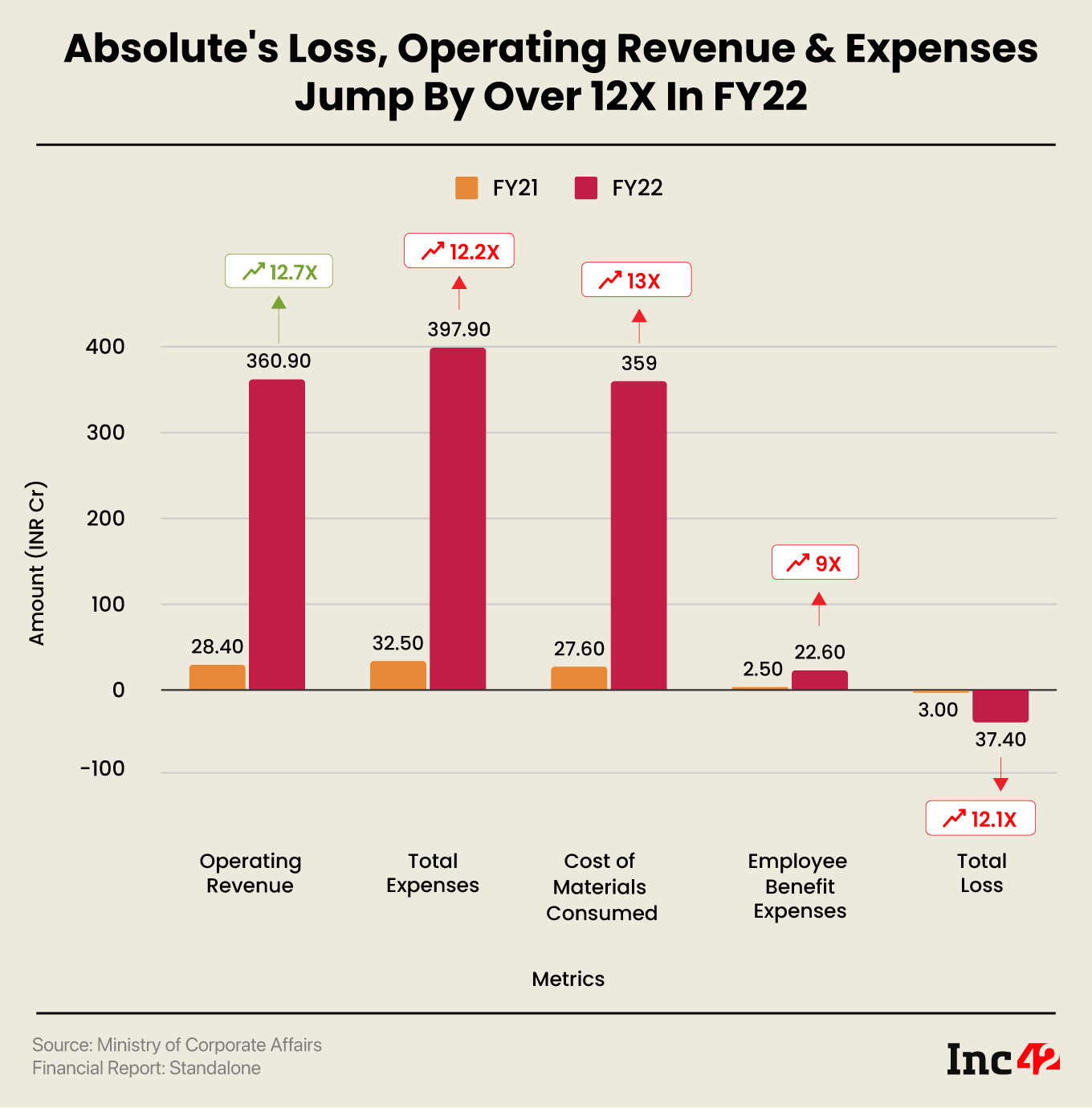

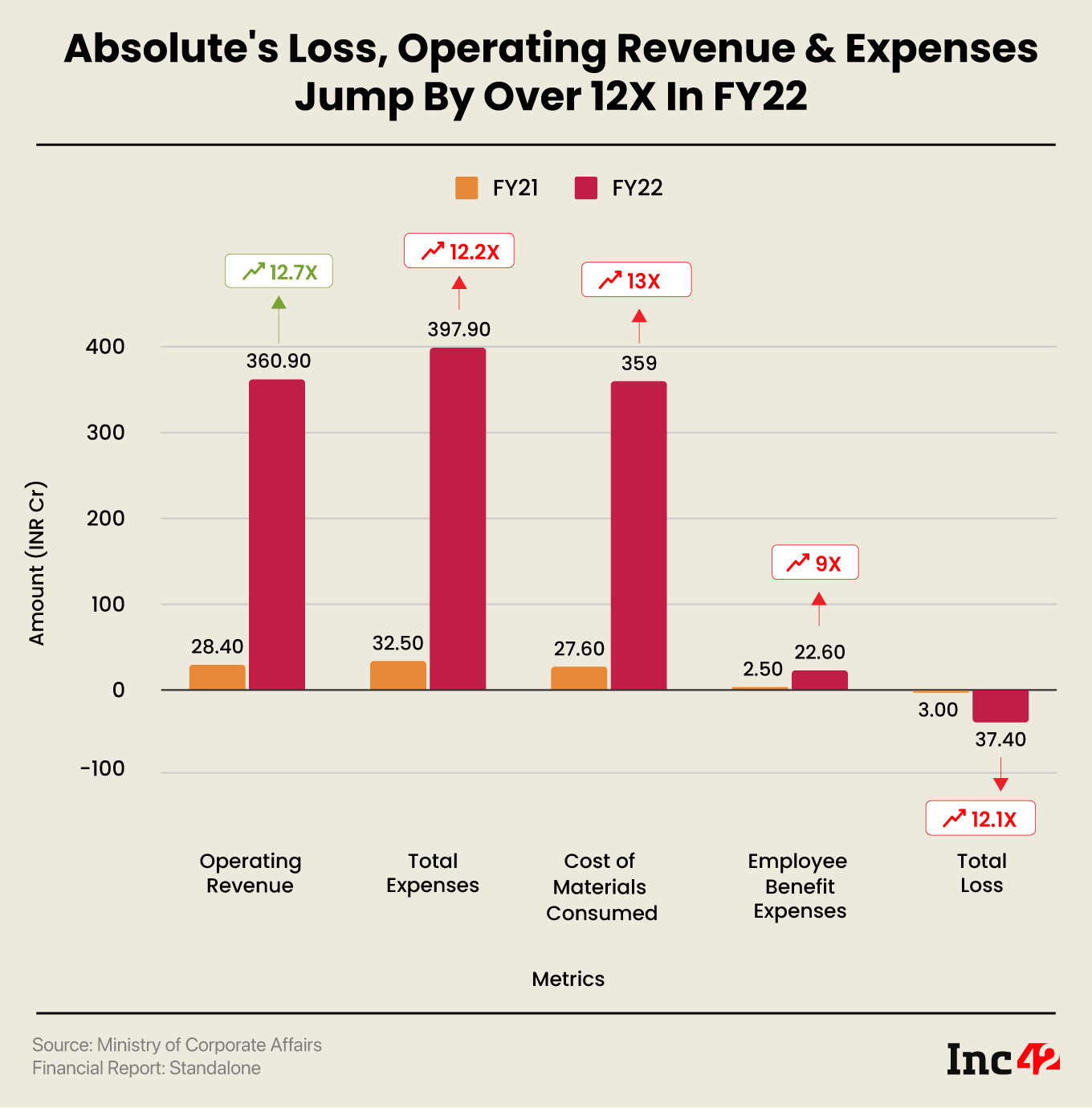

Agritech startup Absolute reported a 12.5X rise in its net loss to INR 37.4 Cr in the financial year 2021-22 (FY22) from INR 3 Cr in the prior fiscal year on the back of a sharp rise in expenses due to business growth.

Absolute’s operating revenue jumped 12.7X to INR 360.9 Cr in FY22 from INR 28.4 Cr in FY21.

The startup, founded in 2015, controls the entire cycle of agricultural produce – from seed to harvest – in the supply chain. Absolute has developed a digital platform, which is an AI-driven farm operating system, that can be implemented across vertical farms, greenhouses, and open farms. It helps farmers grow crops without using synthetic enzymes. Besides functioning in the domestic market, the startup also exports fruits and vegetables via wholesale trade.

Absolute earns a majority of its revenue from the sale of its products. In FY22, the startup’s income from the sale of products stood at INR 359.6 Cr as against INR 28.4 Cr in the prior fiscal year.

While domestic sales contributed INR 333.4 Cr to its product sales during the year, up 1,072% year-on-year (YoY), export of goods helped the startup earn INR 26.2 Cr in FY22.

As per its website, Absolute currently operates across 16+ countries.

On the other hand, it earned INR 1.3 Cr from sales of services during the year. Total revenue, including interest income and other non-operating income, stood at INR 361.5 Cr in FY22, up 1,170% YoY.

On the expenses front, Absolute spent a total of INR 397.9 Cr in the reporting period as against INR 32.5 Cr in FY21.

In line with the growth of sales, the startup’s cost of materials consumed grew 13X to INR 359 Cr in FY22 from INR 27.6 Cr in FY21.

It must be noted that in March 2021, Absolute raised $2 Mn from Sequoia India and various other angel investors to grow its business.

The startup’s expenditure towards employee benefits also shot up 9X YoY to INR 22.6 Cr in FY22. Out of this, INR 19 Cr was spent on wages and salaries.

Meanwhile, miscellaneous expenses, including freight and forwarding charges, R&D expenses, and quality claims, among others, grew 1,102% YoY to INR 18.9 Cr in FY22.

Besides Sequoia, Absolute is also backed by VC firms like Tiger Global and Alpha Wave, and angel investors like Godrej Industries’ Nadir Godrej, Kamal Aggarwal of Haldiram, and CRED’s Kunal Shah.

The startup, founded by Agam Khare and cofounded by Prateek Rawat, last raised $100 Mn in May last year at a valuation of $500 Mn. It said then that it would use the funding to ramp up hiring and expand to newer geographies and segments.

Absolute competes with the likes of DeHaat, Way Cool, Bijak, Onato, among others.

While DeHaat, which recently raised a funding of $106 Mn in its Series E round, saw a 253% YoY rise in loss to INR 1,563.9 Cr in FY22, WayCool’s loss more than doubled to INR 360.5 Cr.

As per an Inc42 report, the Indian agritech industry is expected to grow to a size of $24.1 Bn by 2025. Of late, the space has become a major focus of investors, backed by the government’s initiatives and focus on modernising the country’s agriculture sector.