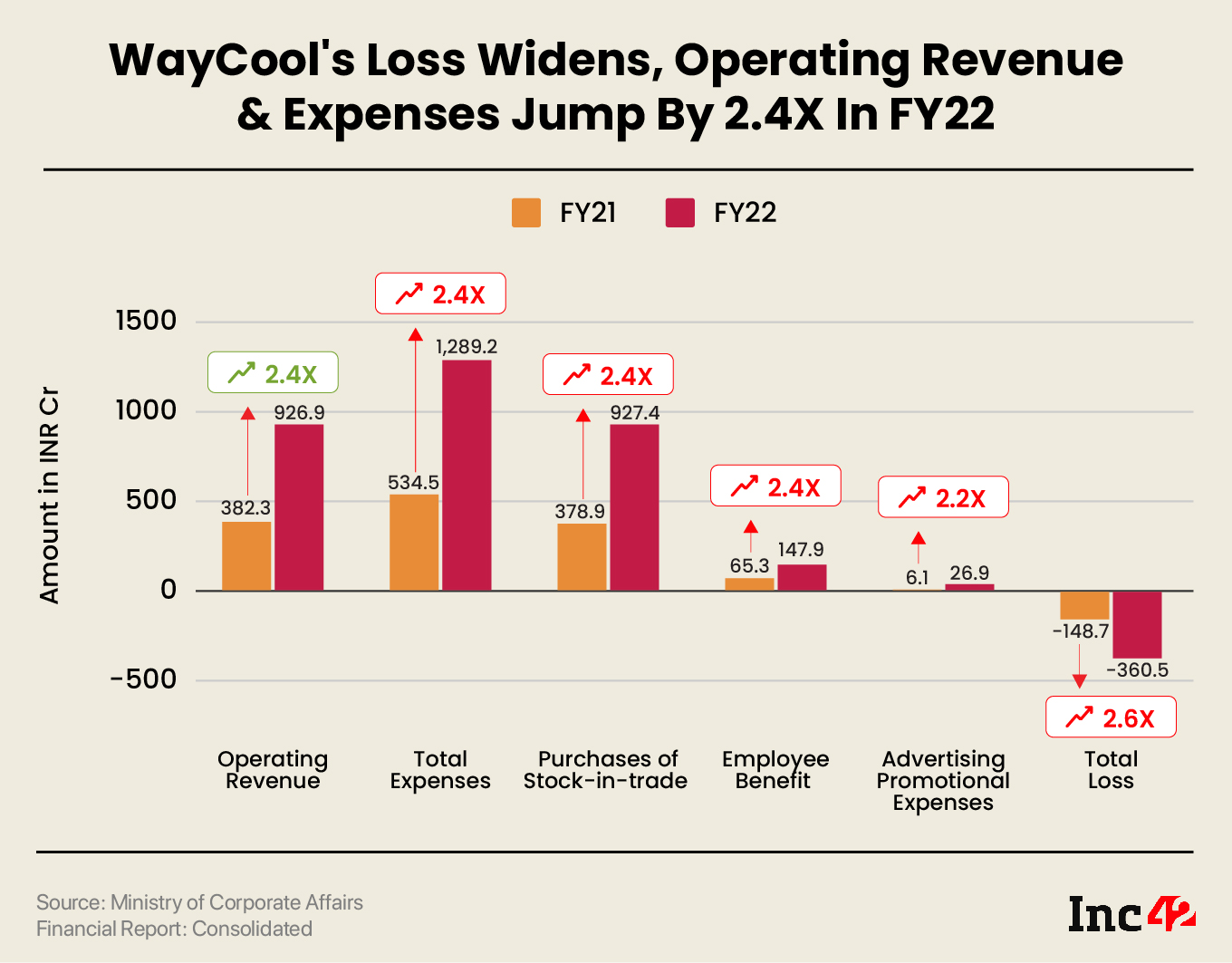

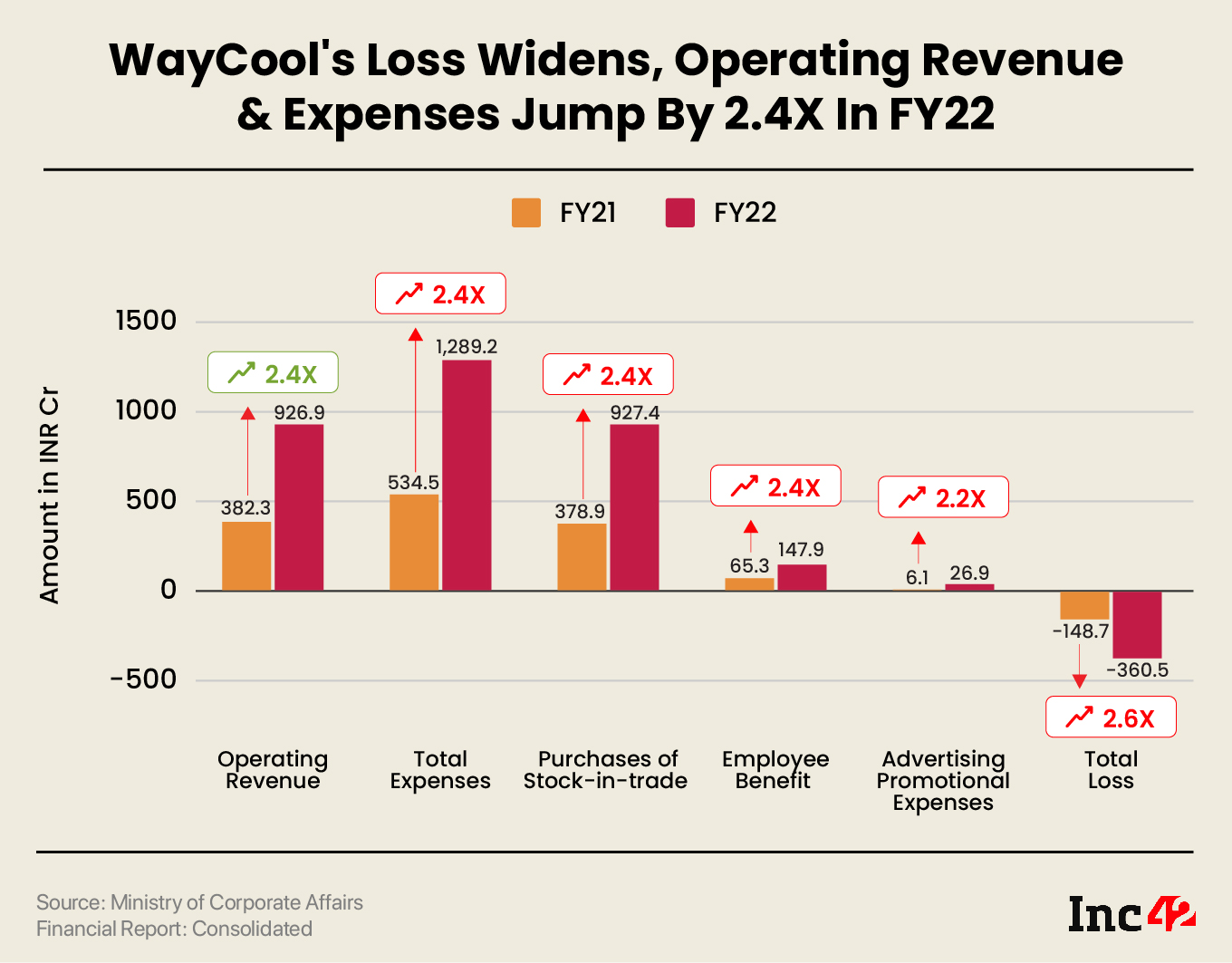

The omnichannel full-stack agri-commerce platform’s operating revenue rose 2.4X to INR 926.9 Cr in FY22 from INR 382.3 Cr in FY21

WayCool’s total expenditure also jumped over 2.4X to INR 1,289.2 Cr from INR 534.5 Cr in FY21

Our mission is to become EBITDA positive by December 2023, followed by four profitable quarters before we list in May 2025: WayCool

Agritech startup WayCool’s net loss more than doubled to INR 360.5 Cr in the financial year 2021-22 (FY22) from INR 148.7 Cr in the previous fiscal year on the back of a sharp jump in expenditure on the purchase of finished goods.

As an omnichannel full-stack agri-commerce platform that distributes farm-sourced agricultural produce to retailers, traders, processors, and others, WayCool earns a majority of its revenue from the sale of its products. In FY22, the startup reported a 2.4X rise in its operating revenue to INR 926.9 Cr from INR 382.3 Cr in FY21.

Total revenue, including interest income and other operating revenue, stood at INR 930.6 Cr during the year under review as against INR 386.9 Cr in FY21.

Founded in 2015 by Karthik Jayaraman and Sanjay Dasari, WayCool raised $117 Mn in its Series D funding round in January 2022 from the likes of LightRock, Lightsmith, LightBox, IFC, Redwood Equity Partners, and Gawa Capital. The startup claims to have a network of over 85K farmers and over 1 Lakh customers.

In line with its revenue, WayCool’s total expenditure also jumped over 2.4X to INR 1,289.2 Cr from INR 534.5 Cr in FY21, with expenditure on purchase of finished goods contributing almost 72% of its total expenses.

The startup spent INR 927.4 Cr towards the purchases of stock-in-trade in FY22 as against INR 378.9 Cr in FY21.

WayCool told Inc42 in a statement that its expenses during the year were predominantly towards strengthening its brands and investing in building its tech stack and associated capabilities. Besides, the startup said that it had a significant non-cash expense increase due to a comprehensive ESOP policy rollout across the company.

As per WayCool’s filings with the Ministry of Corporate Affairs (MCA), its spending towards employee benefits rose 126.5% to INR 147.9 Cr in FY22 from INR 65.3 Cr in the previous year. The startup spent INR 101.6 Cr on salaries and wages as against INR 50.7 Cr in the previous fiscal.

On the other hand, advertisement and promotional expenses rose over 336% to INR 26.9 Cr from INR 6.1 Cr in FY21.

Besides its supply chain operation, the startup owns six food brands – Madhuram, DeziFresh, Fresehys, Kwick Kitchen, L’exotique, and Kitchenji. WayCool runs ad campaigns across television channels and various digital platforms for these brands. The startup, which has a major presence in the southern region of India, recently roped in actress Sneha Prasanna for Kitchenji promotional.

In FY22, WayCool’s miscellaneous expenses, which include material handling charges, inventory write-offs, cost of packaging materials, and casual labour charges, jumped almost 167% year-on-year (YoY) to INR 55.7 Cr.

The startup’s provisions for bad and doubtful debts rose to INR 39.4 Cr from INR 15.2 Cr in FY21.

However, WayCool, in the statement, said that on a net non-cash expense basis, it is better by 210 basis points (bps) in FY22 compared to FY21. Similarly, net of branding and marketing expenses, it is better by 850 bps.

It must be noted that WayCool recently also invested in supply chain management startup AllFresh. The investment came months after it raised $40 Mn in a strategic funding round led by global alternative investment firm 57 Stars.

WayCool also said that it is currently focusing on turning profitable. “Our mission is very clear to become EBITDA positive by December 2023, followed by four profitable quarters before we list in May 2025,” the statement said.

WayCool’s competitor DeHaat reported a 253% YoY jump in its net loss to INR 1,563.9 Cr in FY22, while its operating revenue surged 2.6X to INR 1,273.42 Cr.

Agritech startups in India have been receiving a lot of funding of late helped by various government initiatives and attempts to leverage modern techniques in the industry. An Inc42 report suggests that the Indian agritech industry is expected to grow to a size of $24.1 Bn by 2025.